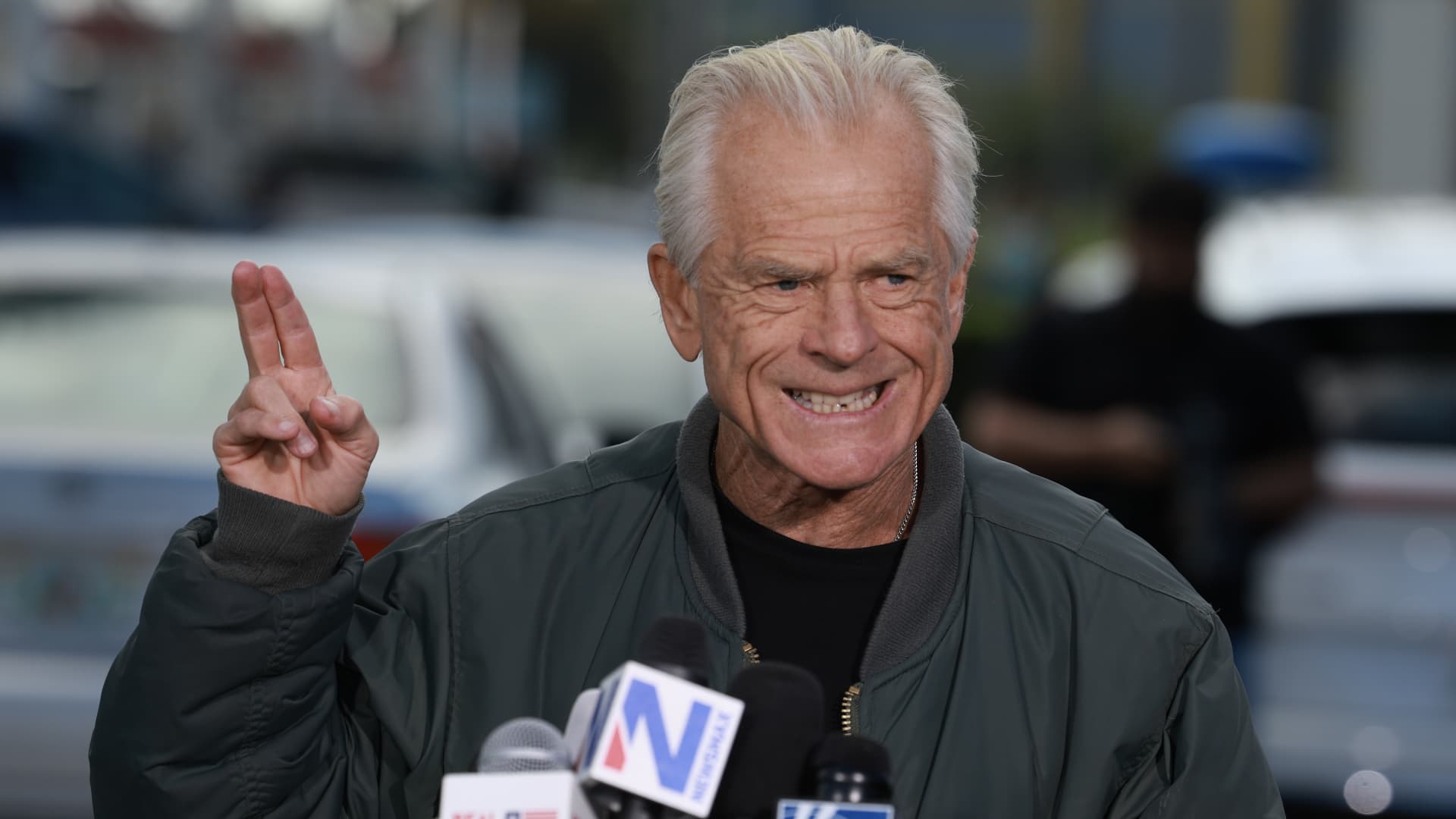

This photo illustration shows an image of former President Donald Trump reflected on a phone screen displaying the Truth Social app on February 21, 2022 in Washington, DC.

Stefani Reynolds | AFP | Getty Images

The share price of Trump media closed trading down 21.47% on Monday, hours after the social media app company linked to former President Donald Trump posted a net loss of $58.2 million on revenue of just 4.1% million US dollars in 2023.

Trump Media & Technology Group Shares plunged more than 25% around 1:08 p.m. ET before recovering slightly later in the day.

Trump Media’s closing price was $48.66 per share, more than $30 below the high of $79.38 per share the company reached last week immediately after going public.

Despite Monday’s sharp decline, the company’s market cap was still nearly $6.6 billion.

But as of Monday’s closing price, Trump’s shares of Trump Media were worth about $3.8 billion, about $2.5 billion less than last week.

Earlier Monday, Trump Media disclosed losses for the last year in its 8-K filing with the Securities and Exchange Commission since going public through a merger with a shell company.

According to the filing, much of the net loss appears to be attributable to interest expense of $39.4 million.

When asked about the results, a spokesperson for the company – which owns the Truth Social app that the former president routinely uses – referred CNBC to a press release the company issued Monday evening.

In this press release, Devin Nunes, CEO of Trump Media, said: “We are pleased to operate as a publicly traded company and secure access to the capital markets.”

“Today, upon completion of 2023 financials related to the merger, Truth Social has no debt and over $200 million in the bank, which opens up numerous opportunities to expand and improve our platform,” Nunes said.

“We intend to take full advantage of these opportunities to make Truth Social the epitome of free expression for the American people.”

The SEC filing shows that Trump Media had net income of $50.5 million in 2022 and total revenue of just $1.47 million.

The gain was primarily attributable to $75.8 million derived from a “change in fair value of derivative liabilities.” This relates to the valuation of Trump Media’s convertible bonds, the report says.

Trump Media’s losses last year could continue for some time, according to the company.

“TMTG expects to incur operating losses for the foreseeable future,” said the announcement, which came a week after the company went public on the Nasdaq under the ticker symbol DJT.

The filing also warns shareholders that Trump’s involvement in the company could pose greater risks to the company than to other social media companies.

TMTG also told regulators that the company identified “material weaknesses in its internal control over financial reporting” when preparing a previous financial report for the first three quarters of 2023.

On Monday, Trump Media stated that these “identified material weaknesses continue to exist.”

More news about Donald Trump

Trump owns 57.3% of Trump Media shares, a stake valued at $3.83 billion.

Forbes reported last week that Trump’s existing stocks account for well over half of his total net worth.

In addition, he is to receive an additional 36 million so-called earn-out shares over the next three years, provided that Trump Media shares reach a number of price benchmarks during this period. These targets are all well below the company’s share price as of early Monday.

Trump Media’s stock price soared as the stock began trading on Tuesday, several days after the company merged with a special purpose acquisition company, Digital World Acquisition Corp., which traded under the ticker symbol DWAC. The newly merged company now operates under Trump’s initials DJT.

Analysts point out that the company’s high valuation is due in part to stock purchases by Trump’s political supporters, who are excited about owning part of a company so closely tied to the presumptive Republican presidential nominee.

However, this enthusiasm poses unique risks for the company. The new 8-K filing states that Trump Media “may face greater risks than typical social media platforms due to the focus of its offerings and the involvement of President Trump.”

In a later 10-K filing with the SEC on Monday, Trump Media listed several risks related to its most famous shareholder.

“TMTG’s success depends in part on the popularity of its brand and the reputation and popularity of President Trump,” the 10-K filing states. “Adverse reactions to President Trump-related advertising or the loss of his services could negatively impact TMTG’s revenue and operating results.”

The filing also states: “President Trump is the subject of numerous lawsuits. An adverse outcome in one or more of the ongoing legal proceedings could have a negative impact on TMTG.”

Don’t miss these stories from CNBC PRO:

Source link

2024-04-02 03:33:23

www.cnbc.com