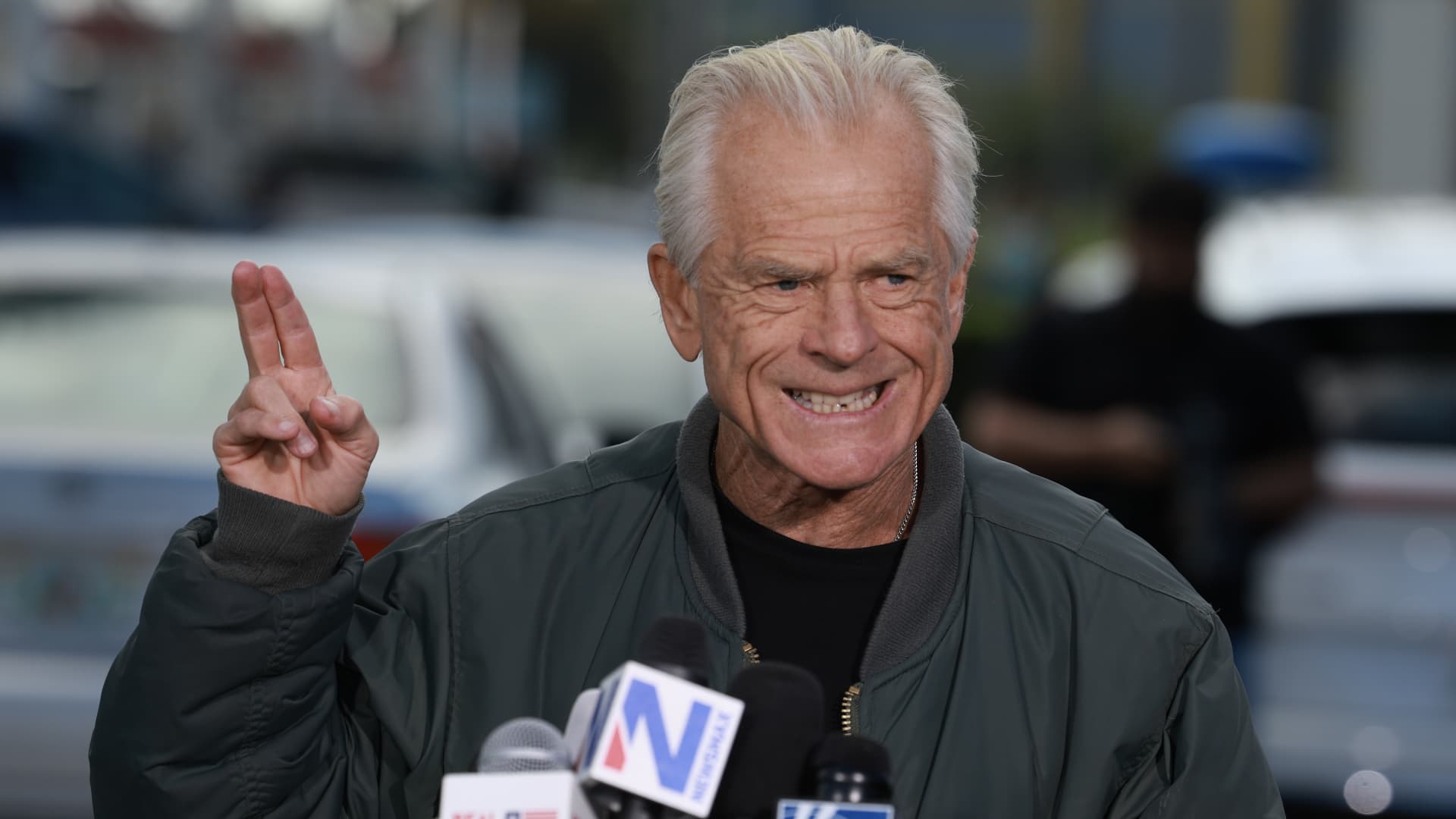

Gasoline prices are displayed at a gas station in Chicago, Illinois on March 12, 2024.

Scott Olson | Getty Images

A closely watched report from the Labor Department expected on Wednesday is expected to show that little progress is being made in the fight against inflation.

If so, that would be bad news for consumers, market participants and Federal Reserve officials who hope price increases are slow enough to begin phasing interest rates later this year.

The consumer price index, which measures the costs of a broad basket of goods and services in the $27.4 trillion U.S. economy, is expected to post a 0.3% increase for both the overall measure and the core indicator, which excludes volatile foods and energy.

On a 12-month basis, inflation rates would be 3.4% and 3.7%, respectively, representing a 0.2 percentage point increase in the headline rate compared to February and only a 0.1 percentage point decrease in the core rate, and both are always still a long way from the central bank’s 2% target.

“We’re not getting there fast enough and we’re not convincing enough, and I think that’s what this report will show,” said Dan North, senior economist at Allianz Trade North America.

The report will be published at 8:30 a.m. ET.

Progress, but not enough

North said he expected Fed officials to view the report largely the same way, reinforcing comments they’ve made for weeks that they need more evidence that inflation is convincingly headed back to 2% before it starts Interest rate cuts may come.

“A convincing approach to the 2 percent mark does not just mean reaching the 2 percent mark for a month. It means hitting the 2 percent mark or less for months,” North said. “We are still a long way from that, and that will probably be the case tomorrow.”

Of course, inflation has fallen dramatically since peaking above 9% in June 2022. From March 2022 to July 2023, the Fed decided on eleven interest rate increases totaling 5.25 percentage points for its key overnight interest rate, known as the federal funds rate.

However, progress has been slow in recent months. In fact, the headline CPI has barely changed since the central bank stopped raising interest rates, although the core interest rate, which policymakers view as a better barometer of longer-term trends, has fallen by about a percentage point.

While the Fed monitors the CPI and other indicators, it focuses primarily on the Commerce Department’s personal consumption expenditures index, sometimes called the PCE deflator. Accordingly, overall inflation was 2.5% in February and the core rate was 2.8%.

Markets, for their part, have become nervous about inflation and its impact on interest rate policy. After making big gains earlier in the year, stocks have fallen over the last week or so, experiencing sharp swings as investors tried to make sense of the conflicting signals.

Earlier this year, traders in the Fed funds futures market priced in the likelihood that the central bank would begin cutting rates in March and implement up to seven rate cuts by the end of 2024, according to CME Group’s FedWatch calculations. The action will begin at least by June and may not total more than three, assuming quarter percent increments.

“I don’t see much here that’s going to magically move things the way they want,” North said.

What you should see

There will be some key areas to consider in Wednesday’s report.

Beyond the headlines, trends will be important on topics such as accommodations, airfares and vehicle prices. These areas have been frontrunners in the current economic cycle, and moves in one direction or the other could indicate longer-term trends.

Economists at Goldman Sachs expect sharp declines in air travel-related items and vehicle sticker prices, and expect smaller increases in the cost of accommodations, which make up about a third of the CPI weighting. But a New York Fed survey released Monday showed a sharp increase in expectations for rental costs next year, which is bad news for policymakers who have often cited falling housing costs as a cornerstone of their thesis of easing inflation.

Similarly, the National Federation of Independent Business’ March survey released Tuesday showed small business confidence at its lowest level in more than 11 years, with owners citing inflation as their biggest concern.

“Inflation is cumulative and that’s why prices still feel high,” North said. “People still can’t believe how high the prices are.”

Gas prices could also play an important role in the CPI release after rising 3.8% in February. Although the gasoline index has remained relatively flat over the past two years, it is still up more than 70% since April 2020, when the brief Covid-induced recession ended. The price of food has increased by about 23% over the same period.

Don’t miss these stories from CNBC PRO:

Source link

2024-04-09 20:47:54

www.cnbc.com