One of the International Monetary Fund’s top economists is signaling a low risk of a global recession despite ongoing geopolitical uncertainty.

The Washington DC-based institute this week slightly raised its global growth outlook to 3.2% in 2024 and forecast the same rate in 2025.

“If we do the risk assessment around that baseline, the likelihood of us seeing something like a global recession is pretty low. At this point, it’s going to take a lot to derail this economy. So there’s been tremendous resilience in terms of the growth outlook,” Pierre-Olivier Gourinchas, economic adviser and director of research at the IMF, told CNBC’s Karen Tso on Tuesday at the group’s meeting in New York.

The “good news” includes strong economic performance in the U.S. and several emerging markets, as well as a faster decline in inflation than until recently expected, although growth in Europe is weaker, Gourinchas said.

There is a divergence within Europe, he added: the IMF has lowered its growth forecasts for Germany, France and Italy, but raised them for Spain, Portugal, Belgium and the United Kingdom

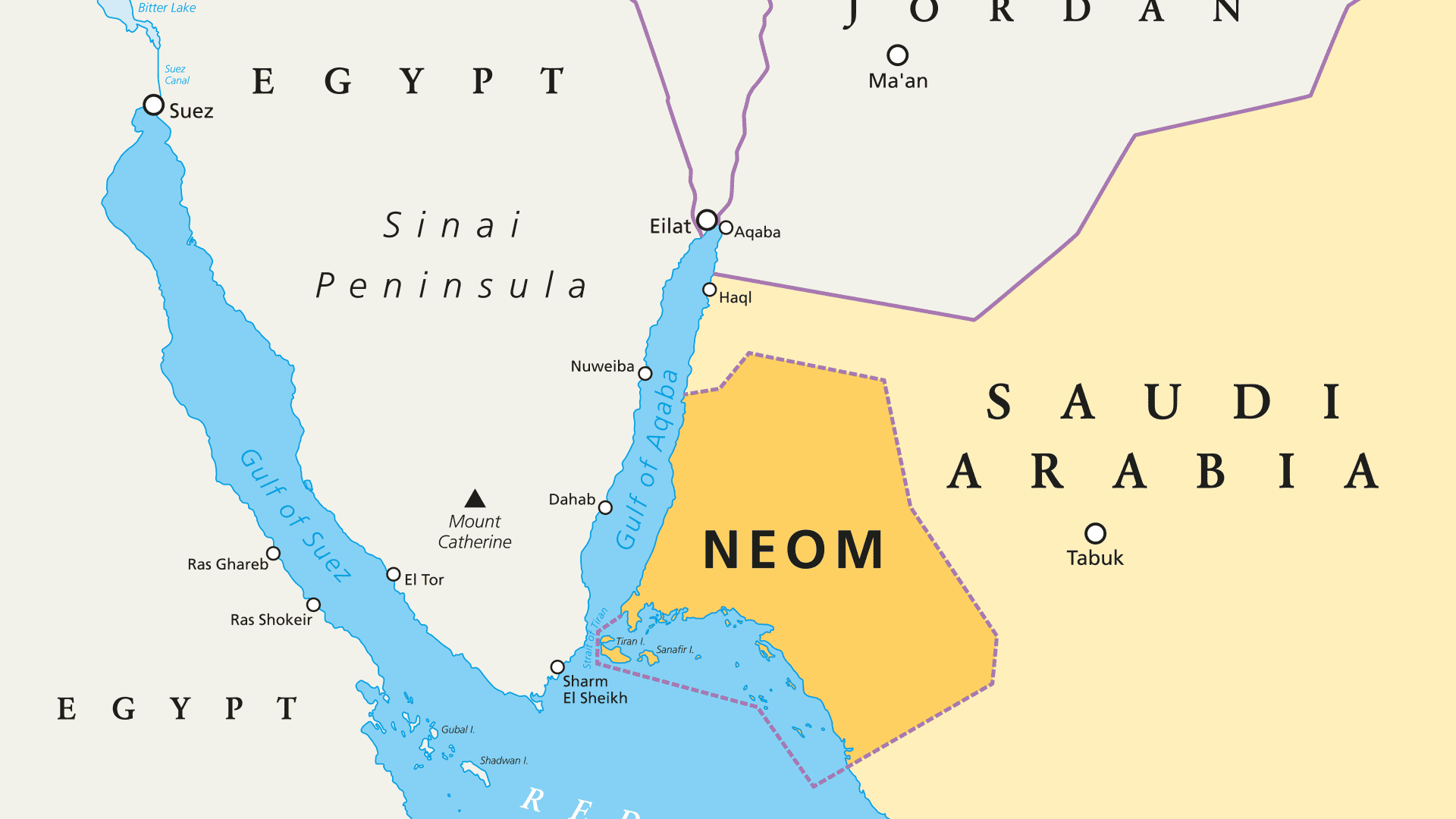

Growth forecasts since autumn last year have had to take into account increasing geopolitical instability, with tensions in the Middle East threatening the oil market, while Israel’s war with the Palestinian militant group Hamas in Gaza led to disruptions in Red Sea shipping routes. by sea attacks by Yemeni Houthis. Added to this is the ongoing war between Russia and Ukraine, which had its biggest impact on energy prices in Europe in 2022.

Gourinchas noted that a significant and sustained increase in oil prices throughout 2024 and further disruptions in supplies between Asia and Europe would fuel inflation in 2024, which would then result in central banks keeping interest rates high for longer and the global would burden growth.

Economic Advisor and Director of Research Pierre-Olivier Gourinchas makes a statement during the presentation of the World Economic Outlook at the International Monetary Fund during the 2024 Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington DC. United States on April 16, 2024.

Celel Gunes | Anadolu | Getty Images

The IMF estimates that a sustained rise in oil prices of about 15% in 2024 would raise global inflation by about 0.7%, although the value of the commodity has so far proven relatively stable despite the recent rise in tensions between Israel and Iran has.

Despite the positive recent forecast, Gita Gopinath, the IMF’s deputy managing director, told CNBC on Tuesday that she assessed geopolitical risks as a “major concern.”

“We have somehow managed the situation so far and we do not see any major spillover effects from the Middle East. But that is not a given. And that’s one of the big risks that we see, the impact it could have on oil prices.” “If the conflict escalates, it could become a much larger conflict,” she said.

Source link

2024-04-17 13:42:28

www.cnbc.com