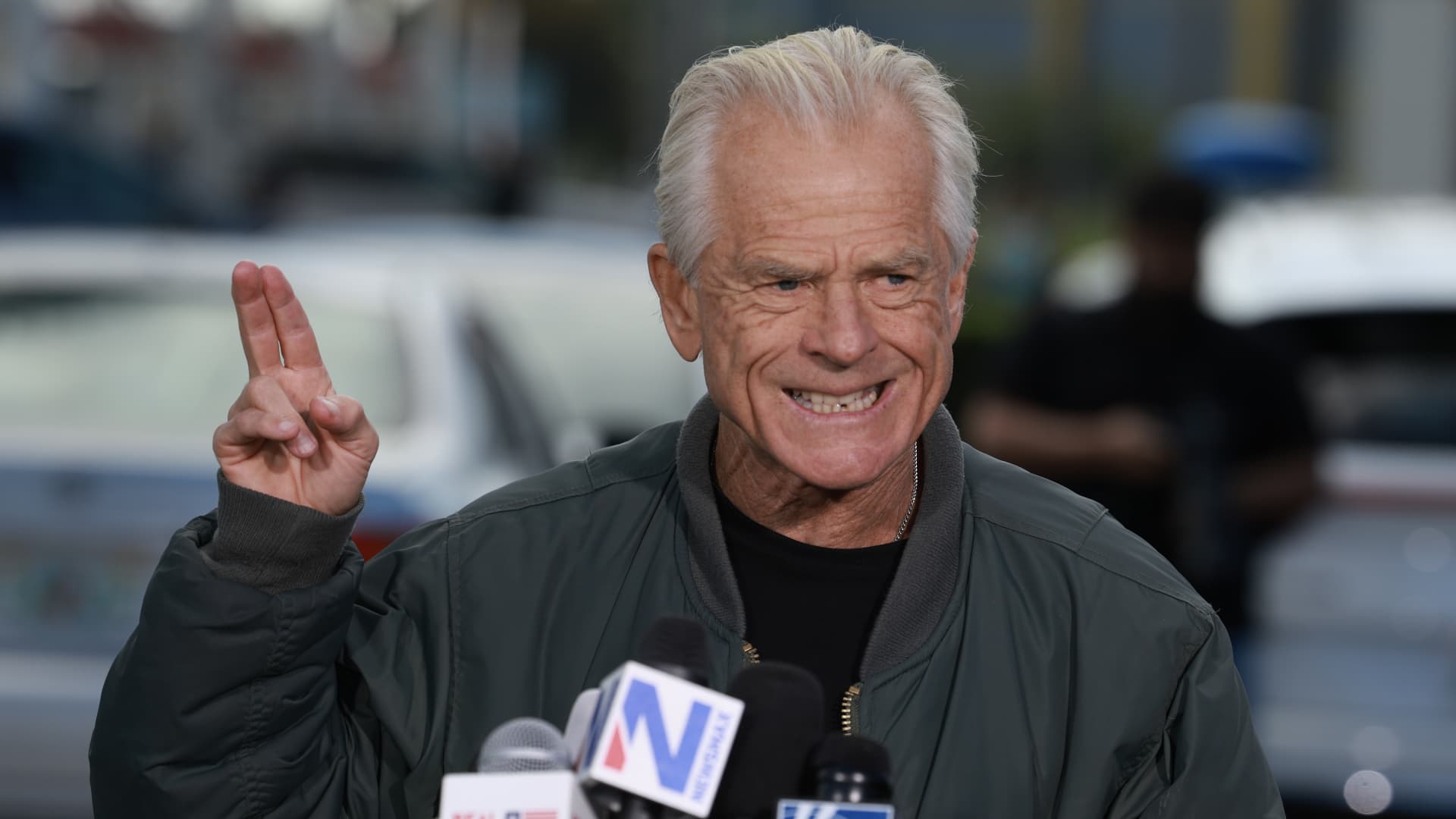

Jamie Dimon, CEO and Chairman of JPMorgan Chase, gestures as he speaks during the U.S. Senate Committee on Banking, Housing and Urban Affairs’ hearing on oversight of Wall Street firms on Capitol Hill in Washington, U.S., December 6, 2023 .

Evelyn Hockstein | Reuters

JPMorgan Chase CEO Jamie Dimon warned Friday that several challenges, particularly inflation and war, are threatening an otherwise positive economic environment.

“Many economic indicators remain favorable,” said the head of the largest U.S. bank by assets as he announced first-quarter earnings results. “However, looking forward, we remain aware of a number of significant uncertain forces.”

A “troubling” global landscape, including “terrible wars and violence,” is one such factor unsettling both JPMorgan’s business and the broader economy, Dimon said.

Additionally, he noted “persistent inflationary pressures that are likely to continue.”

Dimon also pointed to the Federal Reserve’s efforts to shed the assets it holds on its $7.5 trillion balance sheet.

“We have never seen the full impact of quantitative tightening on this scale,” Dimon said.

The latter comment refers to the nickname given to a process the Fed uses to reduce the amount of Treasury bonds and mortgage-backed securities it holds.

The central bank is allowing up to $95 billion in maturing bond proceeds to flow out each month instead of reinvesting them, resulting in a $1.5 trillion decline in holdings since June 2022. The program is part of the Fed’s efforts to tighten financial conditions in hopes of easing inflationary pressures.

Although the Fed is expected to slow the pace of quantitative tightening in the next few months, the balance sheet will continue to shrink.

Taken together, Dimon said, the three issues represent significant unknowns.

“We don’t know how these factors will play out, but we need to prepare the company for a wide range of potential environments to ensure we can always be there for our customers,” he said.

Dimon’s comments come amid renewed concerns about inflation. Although the pace of price increases has slowed significantly since peaking in June 2022, data so far for 2024 shows that inflation is consistently above expectations and well above the Fed’s annual target of 2%.

As a result, markets have had to dramatically change their expectations of interest rate cuts. While markets had expected up to seven cuts, or 1.75 percentage points, at the start of the year, they are now expecting just one or two, equivalent to half a percentage point at most.

Higher interest rates are generally viewed as a positive for banks as long as they do not lead to a recession. JP Morgan reported an 8% increase in first-quarter revenue on Friday, driven by higher interest income and higher loan balances. However, the bank warned that net interest income for this year could be slightly below Wall Street’s expectations and shares fell nearly 2% in premarket trading.

Source link

2024-04-12 15:12:18

www.cnbc.com