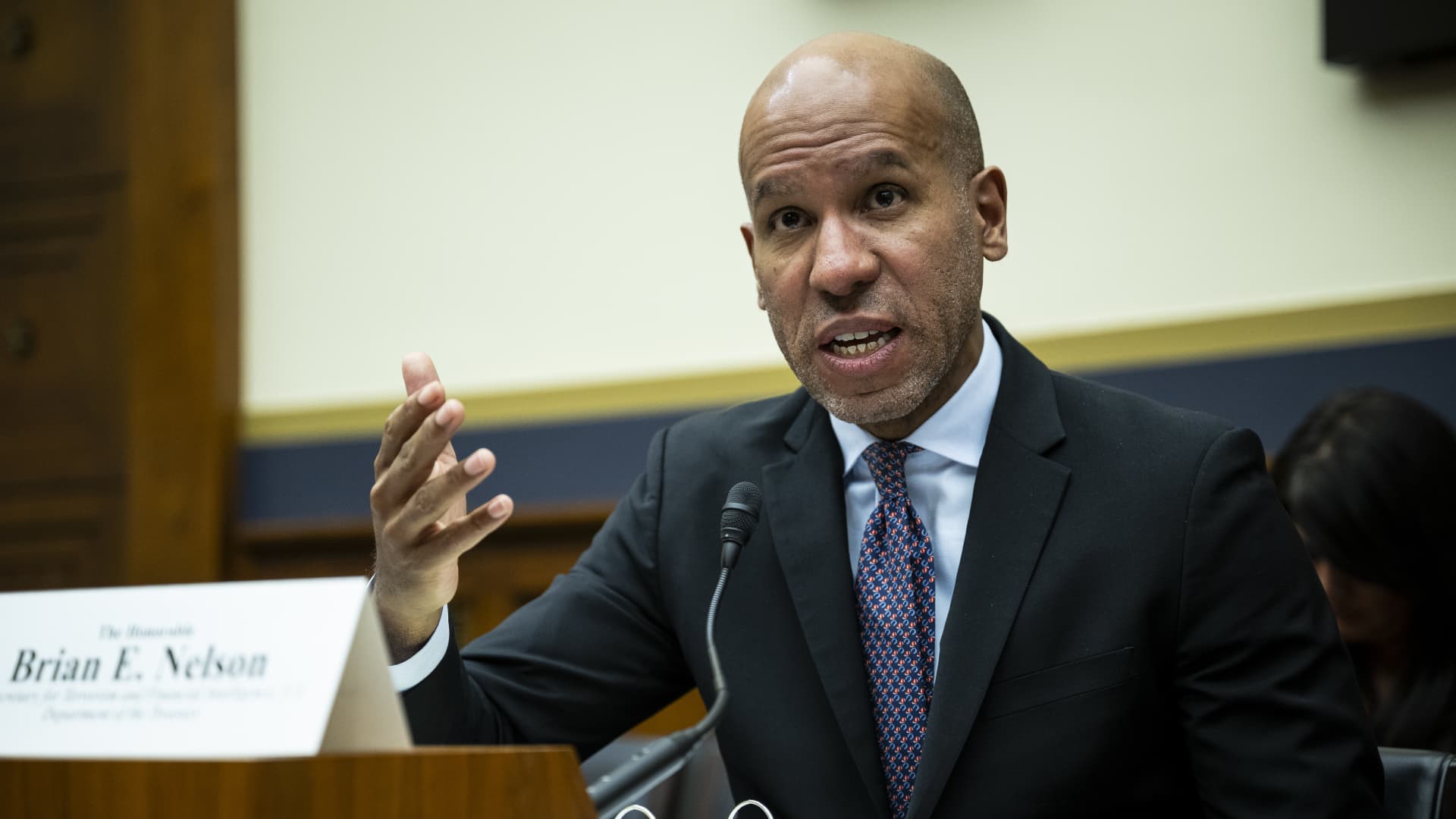

Brian Nelson, U.S. Treasury Under Secretary for Terrorism and Financial Crimes, during a House Financial Services Committee hearing in Washington, DC, USA, on Wednesday, February 14, 2024. The hearing is titled “Oversight of the Financial Crimes Enforcement Network (FinCEN ). ) and the Office of Terrorism and Financial Intelligence (TFI).”

Graeme Sloan | Bloomberg | Getty Images

WASHINGTON – More than 700,000 companies have submitted data to the Treasury Department’s new beneficial ownership information registry, a senior Treasury official said Wednesday. However, the number is well below what is needed to reach an estimated 32.6 million registrants by the end of the year.

“I think as people in companies become more aware of this requirement, the more demonstrable the experience becomes that it only takes 15 to 20 minutes… I feel like people are becoming more comfortable with it, but.” “We are “We recognize that we still have a lot of work to do,” said Brian Nelson, undersecretary for terrorism and financial intelligence at the Treasury Department, during an interview at the Hudson Institute, a think tank here.

The Financial Crimes Enforcement Network launched the BOI registry on January 1st. The registry, established under the Corporate Transparency Act, is intended to assist law enforcement agencies, banks and regulators in detecting financial crimes.

Certain companies incorporated or registered to do business before the New Year will have up to a year to file their paperwork. According to FinCEN, newly formed companies have up to 90 calendar days to register their beneficial ownership information.

Registrations have increased from over 100,000 registered a week after the registry opened, but companies should register at a rate of about 2.7 million per month to meet stated expectations.

Nelson said the agency has been “in full force in court” to raise awareness of the registry.

“It’s as much about reporting for education and compliance as it is about obtaining high-quality information that is valuable to law enforcement so that we can identify the bad actors, the shell companies and those who are trying to abuse our financial system he added.

“A lot of small businesses, small businesses, have never heard of FinCEN,” Nelson said. “Perhaps the vast majority have never heard of FinCEN.”

“And secondly… this is a new, novel reporting requirement,” he added.

Nelson said the Treasury Department is using multilingual guides, informative webinars and YouTube and working with secretaries of state and chambers of commerce to inform business owners.

“Law enforcement, national security, intelligence … this data is for them,” Nelson said. Uploaded reports require identifying credentials, such as the name and location of a registered business.

“The lack of this necessary information will at least shine a light on the question, ‘Hey, this is a cause for concern and we should use our law enforcement resources to try to address the problem that this company is involved in.’ where we have no insight into the beneficial owner.’ ‘”

The BOI pushes the U.S. to follow the recommendations of the Financial Action Task Force, which sets international standards for anti-money laundering and anti-terrorism measures. The United Kingdom, for example, has had an active registry since 2016.

“The United States had no economic ownership regime to speak of,” Nelson said. “So I have the great honor and privilege to tell you that as of January 1st, we have a registry that is working and with thousands signing up.”“

Source link

2024-02-28 23:42:44

www.cnbc.com